Do you think your marketing strategy is working well? Or do you KNOW it is?

There’s a world of difference between those two questions, and while most companies would like to believe they’re in the latter camp, too many are basing their marketing campaigns on assumptions, guesswork and luck.

The truth is that unless you have a fully functional lifecycle marketing strategy, and are tracking, measuring, reviewing and revising it regularly, you can’t be certain that your marketing budget is giving you the best return on investment.

It might not even be giving you a good return on investment.

To find out if your marketing is really working for you, here are five questions you need to answer.

1) What’s the role of LTV?

Why is it important to know the lifetime value (LTV) of your customers?

LTV is the total value a customer will contribute to your business over their lifetime. It helps you understand what you can spend to acquire a new customer without losing money. And it gives you a reference point to help you make changes to increase the value of each customer through lifecycle marketing.

According to the Australian Bureau of Statistics, more than 60% of small businesses cease operating within the first three years of starting. And most of these businesses fail because they do not understand their customer’s lifetime value.

To give you an example, your average order value (AOV) might be $70, but if you’re paying $150 to maintain or acquire each customer then you are going to run into problems quite quickly.

By tracking your LTV, you can plan the best way to communicate to your customers across their lifecycle, to ensure they continue to spend and, just as importantly, increase their AOV.

2) Which should you prioritise – new or existing customers?

A common agreement across e-commerce and business growth books is that the probability of selling to a new prospect is 5-10%, while the probability of selling to an existing customer is 60-80%.

So you would naturally assume that the best way to spend your marketing budget is to focus primarily on existing customers across your lifecycle marketing planning, right?

And indeed, in the short term this will help you to maintain your LTV, which would ensure a baseline of sales to remain operational.

However, long term this is a risky strategy. Why? Because the quality and size of your audience lifecycle funnel will begin to dilute over time. Even if you retain 80% of your customers each year, the overall value will start to drop – especially when external factors, such as completion, come into play.

3) How do you know if you are succeeding at new customer acquisition?

So how can you tell if your customer acquisition strategy is working? To find out you need to factor in your customer acquisition cost (CAC).

Let’s look at a simple example to see how effective a business is at acquiring new customers.

Milan’s Croatian Cakes acquires 1,000 new customers spending an AOV of $80. They spend $30,000 on various marketing campaigns (display, social, search) to help reach those new customers. The operational cost for filling each of the orders is $50. Their customer retention is 70%.

Is the above new customer strategy succeeding? To work this out, we need to calculate the ratio of lifetime value to customer acquisition cost.

To do that, let’s work out our customer acquisition cost:

If Milan’s Croatian Cakes spent $30,000 on marketing and acquired 1,000 new customers, then their CAC is $30.

Next, we need to calculate the lifetime value (LTV) of their customers:

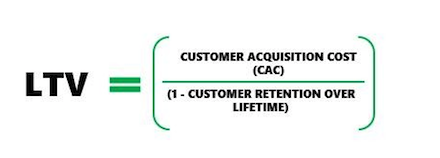

If their CAC is $30 and their customer retention rate is 70% then the calculation is: $30 / (1-70%), which gives them a LTV of $100.

With this information we can gauge whether they are succeeding with their new customers acquisition strategy. To do this, we work out our ratio by taking the LTV and dividing it by the CAC:

$100 (LTV) / $30 (CAC) = 3.3x index

This shows that Milan’s Croatian Cakes has a ratio of lifetime value to the customer acquisition cost of 3.3 times their baseline.

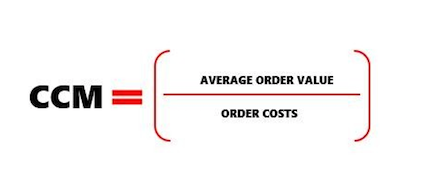

As a bonus, we can take the customer contribution margin (CCM) from the example and determine how profitable those Croatian cakes really are:

If their average order value is $80, and their average order cost is $50, then their CCM is $30.

By using the above calculations, you work out how effective you are (and have previously been) with acquiring new customers and maintaining profitability.

4) When should you think about ROAS?

Customer acquisition cost is directly impacted by the return on advertising spend (ROAS) of your lifecycle marketing spend.

So what is ROAS, and how do you work it out?

ROAS is simply the revenue from the ad campaign/cost of the lifecycle ad campaign.

A lower average ROAS will mean less new lifecycle customer acquisition for the same ad spend, and it will impact your CAC. Eventually, as your customer base begins to shrink, so to will your LTV and things become dangerous for the future success of your business.

When you spend your business resources on an ad, the goal is to make sure that ad produces as much revenue as possible.

So it is vital to have the right advertising strategies in place.

5) What are the right strategies?

Before you spend a dollar on advertising, you need to ensure your website is correctly set up across your floodlights (Tag Manager), CRM and other analytic tools.

Here are some considerations.

Data layers

There are still many e-commerce businesses not tracking and maintaining their data layers correctly.

A data layer is a JavaScript variable that stores and sends information from your site to a tag manager (most likely GTM and eventually is transferred to other tools, like Google Analytics).

It is important as it allows you to track data points such as the product names, prices, basket quantity, and etc so you can make informed decisions on how your customers are engaging with your store and thus how to better communicate with them across their lifecycle.

Understanding your audience lifecycle behaviour

To target the right people, at the right time, with the right message, you need to understand exactly who the right people are.

If your current advertising strategy is to simply retarget every user that has looked at a product page or added something to the cart then you are not learning as much about your audience’s behaviour as you can.

If your business is selling Croatian cakes online then perhaps you should consider:

- Where are my customers purchasing my cakes at a geo level?

- Is there a relationship between product and geo?

- Which cake is selling better than others?

- What factors are influences product purchases (weather, affluence, etc)?

- How much are you average basket value vs final sale?

- Can you offer any incentives to drive larger transactions? If so, where and when?

Do you need help getting your lifecycle right?

As you can see, there are variants you you need to get right to have a full functioning marketing lifecycle that is delivering the maximum return on your advertising spend.

If you’d like to improve the results of your display advertising campaigns we’d be happy to help – just get in touch.