2020 has been a challenging year for most sectors, including the financial sector, thanks to the global pandemic.

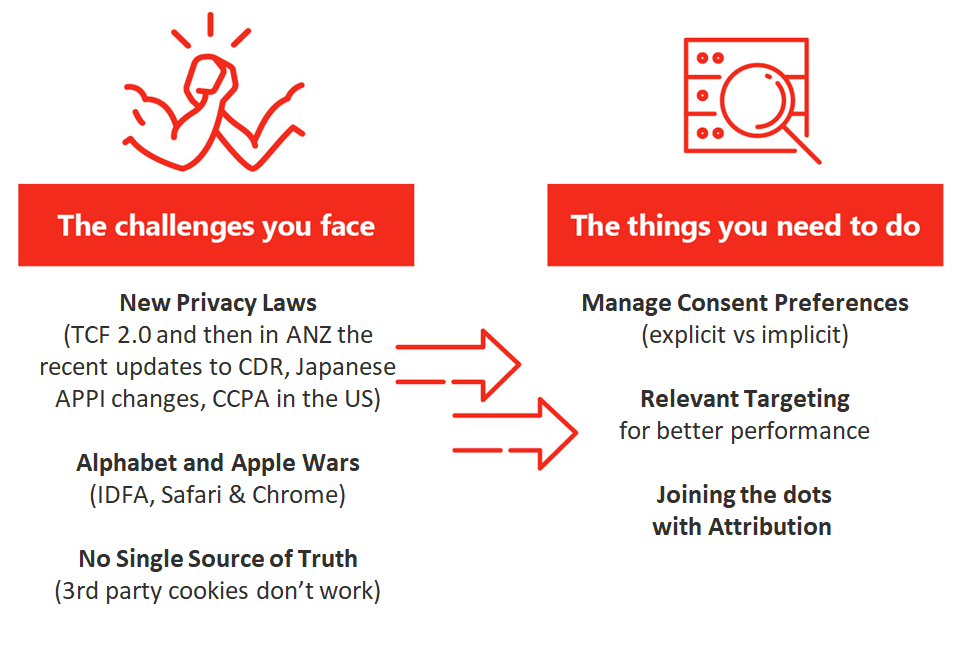

However, there are challenges in market that brands can’t afford to overlook. We delve into what these challenges are, and how you can overcome them.

What are the market challenges for the finance sector

The challenges brands face today

The challenge of Life without cookies: How ITP Safari and Chrome is changing

What you need to know

Safari

- Apple feature on Safari prohibiting cookies

- Cookies now expire within 24 hours

Problems with attribution in Safari

- Attribution such as path to conversion reports in DCM will no longer be accurate on Safari

- For marketing teams, this means they do not see the full value of all their channels like Facebook or Display which will skew planning and buying

- Tracking across all Safari significantly reduced for all performance channels and technologies relying on cookies and third-party attribution

Chrome

- Google feature on Chrome prohibiting cookies

- Cookies that do not include certain parameters cannot be accessible.

- Existing cookie based audiences will no longer work

Problems with attribution in Chrome

- Still speculation, however, Google will most likely only support running activity on Chrome and Google products.

- Eternal DSP, ID SSP, etc will not be fully supported by Google’s measurement tools.

- Meaning attribution for any product outside of Google such as Facebook, AppNexus, The Trade Desk, and so on will be significantly reduced.

Crimtan’s solution

- Crimtan’s solution is using our Universal ID solution called ActiveID to measure the undeduped users we have been driving conversions on Safari within the Crimtan platform.

- Crimtan then work with advertisers to match Crimtan ID’s directly with transaction IDs (eg: DCM) that have recorded on Safari manually. This allows us to connect the dots with their measurement platform so the advertiser can move undefined or organic transactions to a paid channel.

The importance of a universal ID solution

We created ActiveID to help brands run display advertising campaigns that achieve the results they need, and are fully compliant.

ActiveID works within consenTag to create a consented identifier that lasts long enough to carry out lifecycle marketing. And, by using advanced triangulation techniques, ActiveID enables probabilistic user matching in ad exchanges with 95% accuracy.

This means that, with consent, you can deliver relevant advertising across any browser. It also means that the changes brought in with ePR won’t impact your campaigns at all – you’re already one step ahead.

How the customer behaviour is shifting

70% of people don’t trust the banking industry

Public trust in ‘big banks’ is at a all time low. Following the Royal Commission revelations and recent scandals. Plus, ASIC weighing in with legal actions against Comminsure, Hawking insurance & BOQ and Bendigo.

This presents a perfect storm opportunity to capitalise on resentment of the big banks, to bring in new customers .

The new customer

Influence and purchase decisions

64% Of consumers feel more loyal towards brands that show a deep understanding of their preferences & priorities

80% Of consumers consult product news, brand credibility and reviews before making a decision.

Discovering new customers

Getting the creative right

Deliver relevant messaging to peak the users interest even before they have been to the site. Build additional strategies for more personalised creative with banner engagements

Understanding your customer journey

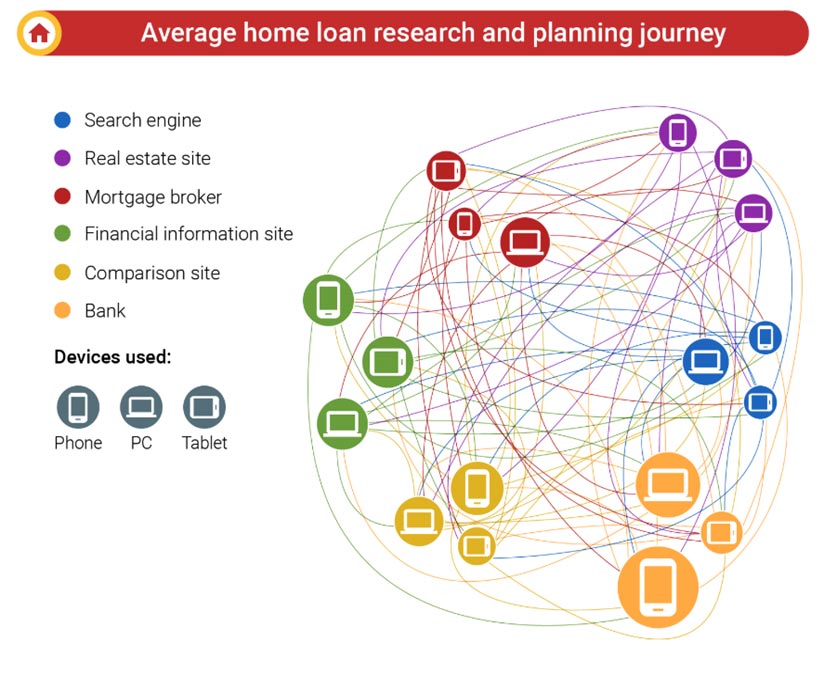

The planning journey

For your customers deciding which home to purchase and what home loan to take is truly a journey.

Key pain points to the consumer are interest rates, monthly payments, customer service, and fluctuations in the housing market.

While many consumers still like to speak with brokers or friends and family for advice, digital offers greater depth of information and always-there convenience.

It’s why digital is the number one source of information.

As more consumers look to understand what length and type of loan they can afford, calculators now make up the majority of all search traffic for home loans.

Consumers spend 70% of their time researching online, 30% of which is spent on mobile.

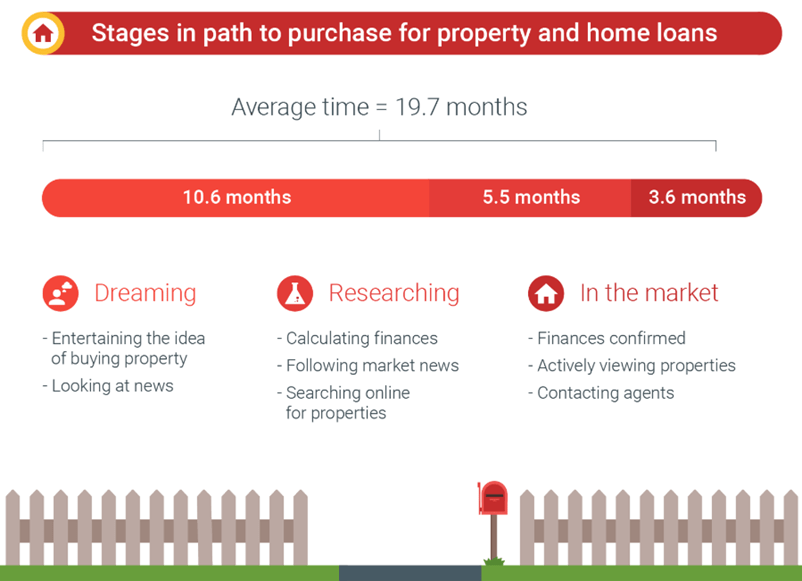

Delivering the right message at the right time

A lot of people start dreaming about buying property nearly a year before they ever start to research different options.

To win their attention and loyalty before they consumers step into another bank or broker, and brands should focus on reaching consumers early with relevant ads, bolstering their online footprint.

What’s most important in these early stages are helpful information such as fees, rates, customer service, and rewards or benefits.

Targeting property and real estate-related search queries and browser history will allow brands to demonstrate early, relevant, helpful information in the precise moment a consumer indicates consideration for a loan application. This will build lasting trust.

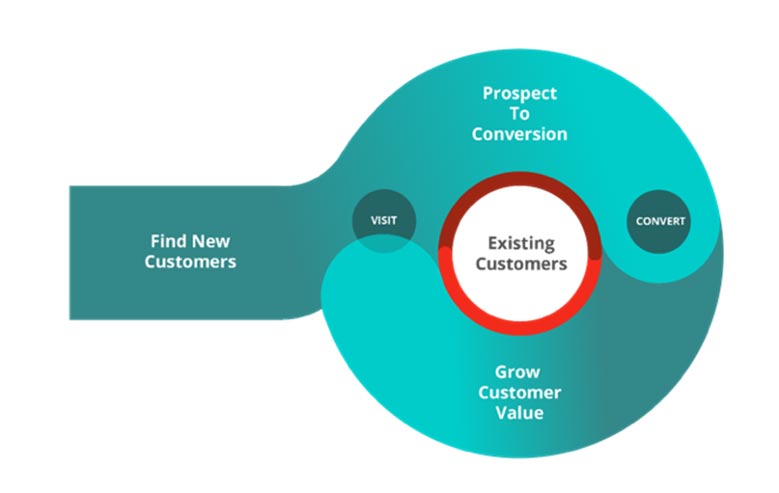

The customer journey simplified

The customer journey can be simplified to 5 key stages, Need/Opportunity for Customer, Consideration, Research, Brand Opportunity and Conversion.

- Needs/Opportunity for customer: They have signaled intent to engage with a financial product or service (eg HL).

- Consideration: What brand fits my values ? With financial uncertainty who can I trust? What is the best deal for me? ‘Money in a mattress’ effect

- Research: Customers engage with relevant content to determine what works best for them?

- Brand opportunity: How do brands communicate relevant values to this new customer

- Conversion: 73% of customers are more likely to convert to a relevant product or service at the right time and environment that aligns with their value

Why we are experts in Lifecycle Marketing

- Programmatic Experts To Help Reach New Customers

- Customer Lifecycle Strategy: Relevant marketing strategies based on ID bases customer segments through our DMP.

- Dynamic Creative: Our own Creative technology that change images and messages instantaneously to allow brands to test between what combination works best in real time against different subsets of their audiences.